Ortho Bridge is a permissioned Real-World Asset (RWA) protocol architected to compress the structural capital latency in US orthopedic reimbursement. Focusing exclusively on high-value Total Joint Arthroplasty (TKA/THA) receivables, the protocol functions as a decentralized liquidity layer that bridges the gap between institutional DeFi capital and standardized healthcare assets.

By leveraging Zero-Knowledge Proofs (ZKPs) for HIPAA-compliant state verification and Optimistic Settlement Engines for execution, Ortho Bridge enables T+1 funding finality for independent providers. The protocol is designed as a “Regulatory Castle,” operating within the codified frameworks of the US Prompt Pay Act, UCC-1 Secured Transactions, and the 2025 SEC Guidance on Tokenized Entitlements.

1. A Brief History of Healthcare and Crypto :

>The Structural Failure of Gen-1 Healthcare Tokens:

The intersection of distributed ledger technology (DLT) and healthcare has historically been characterized by extreme capital inefficiency and speculative excess.

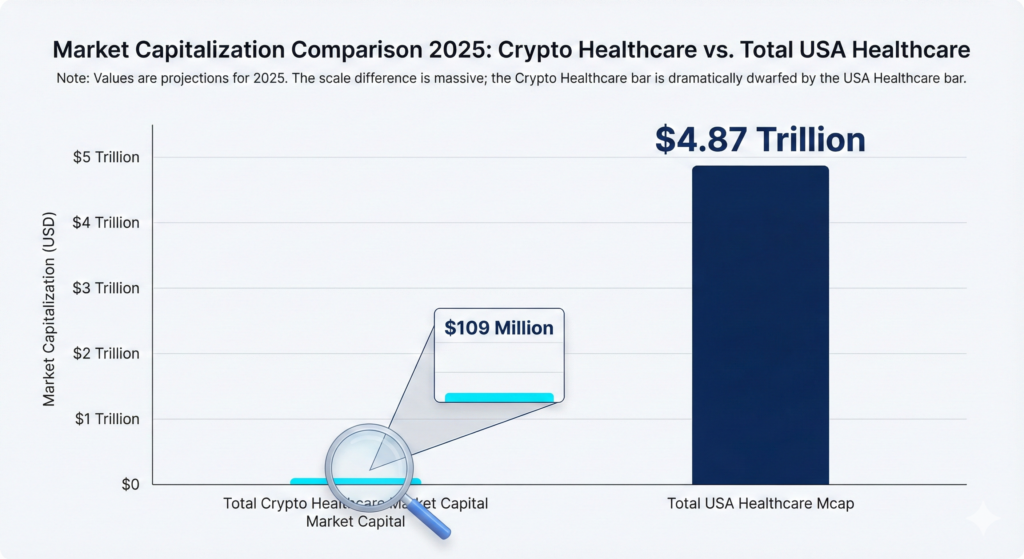

As of December 2025, the aggregate market capitalization of the healthcare crypto sector has settled at approximately $109 Million USD, a figure representing less than 0.1% of the annual revenue of a single major US hospital network.

This valuation reflects a 97% retracement from the sector’s peak.

During the 2021 market cycle, the sector commanded a fully diluted valuation (FDV) exceeding $ 4 Billion , driven primarily by speculative premiums on tokens such as MediBloc ($ MED) and Solve.Care ($SOLVE), which reached valuations of ~$2.5B and ~$300M respectively. (Source : CoinGecko )

The collapse of these valuations (with assets depreciating >99% from all-time highs) indicates not merely a cyclical correction, but a fundamental rejection of the underlying “Patient-Centric Data” business model by the market.

>Taxonomy of Failure Modes

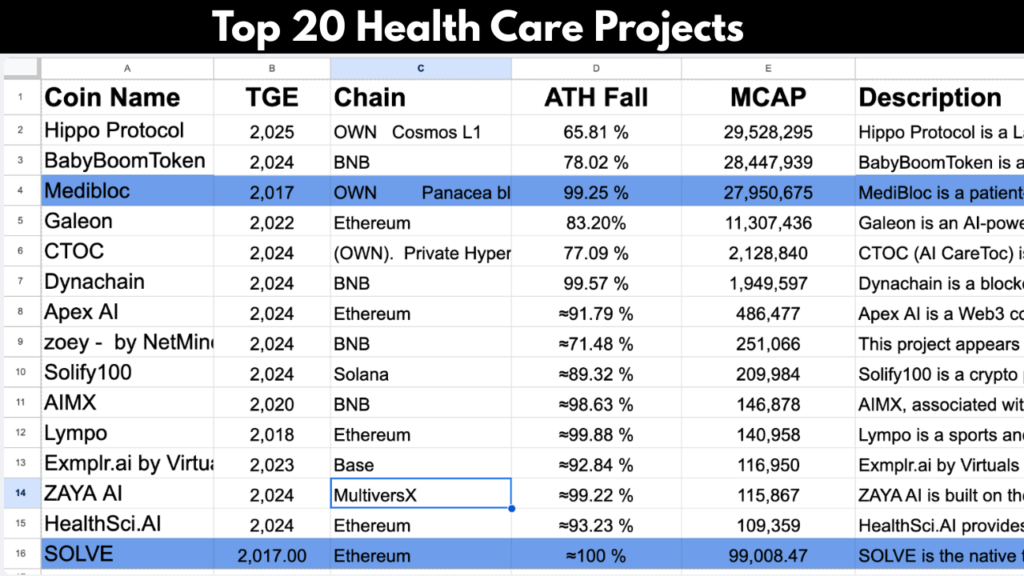

- Google Sheet derived from CoinGecko Data*

An analysis of the top 20 healthcare protocols reveals a systemic alignment failure. These projects predominantly clustered around three “Narrative Verticals” that lacked viable economic feedback loops:

- Decentralized Health Records (DHR): Projects attempting to monetize patient data ownership (e.g., MediBloc).

- Incentivized Wellness: “Move-to-Earn” or lifestyle gamification (e.g., Lympo).

- AI Diagnostics: Speculative tokens promising decentralized diagnostic agents without FDA clearance.

>The Incentive Misalignment:

The failure of these First-Generation models can be attributed to a “High-Trust vs. Low-Trust” Liquidity Gap.

- The Regulatory Barrier: Healthcare is a permissioned, high-trust environment governed by HIPAA and FDA statutes. Crypto protocols are permission-less, low-trust environments. Attempting to bridge this gap without institutional compliance layers (e.g., SOC-2, BAA) resulted in zero clinical adoption.

- The Utility Vacuum: The “Data Ownership” thesis failed because it solved a problem (privacy) that stakeholders were unwilling to pay for. Patients lack the incentive to manage private keys for health records, and insurers lack the incentive to purchase decentralized data streams.

- Absence of Cash Flow: These protocols relied on inflationary token emissions rather than Real World Asset (RWA) cash flows. Lacking integration with major payers (e.g., UnitedHealth, Medicare), they could not capture value from the $4.5 Trillion US healthcare economy.

Conclusion: The market has demonstrated that Utility Tokens without Regulatory Compliance or Fiat Revenue trend toward zero. OrthoBridge posits that the only viable entry point for blockchain in healthcare is Financial Settlement—specifically, the removal of capital latency for providers.

2. The Regulatory Paradigm Shift: From Ambiguity to Codification

>The Post-2025 Compliance Landscape:

For the decade preceding 2025, the integration of distributed ledger technology (DLT) into regulated US capital markets was inhibited by a framework of “Regulation by Enforcement.

As late as 2023, the lack of distinction between Investment Contracts and Utility Tokens rendered compliant healthcare innovation commercially unviable.

However, the regulatory environment underwent a decisive structural shift in Fiscal Year 2025. Through a sequence of judicial rulings and agency guidance letters, the United States has moved from a posture of prohibition to one of Federal Codification.

OrthoBridge is the first protocol architected explicitly to leverage this newly established “Regulatory Bedrock.”

>The Legal Pillars of the Protocol:

The Ortho Bridge architecture is not based on theoretical loopholes but on three specific Federal Safe harbors established in late 2025:

Pillar I: The Tokenization of Entitlements (Asset Layer) Authority:

1.SEC Division of Trading and Markets:

- Precedent: No-Action Letter re: Depository Trust Company (DTC) – Dec 11, 2025.

- Implication: This ruling explicitly permits the “tokenization of security entitlements” on distributed ledgers.

- Protocol Application: This provides the direct legal basis for OrthoBridge’s “Surgery Ticket” (NFTs). These tokens are legally classified not as unregistered securities, but as compliant Digital Representations of Accounts Receivable, governed by the same standards as DTC-cleared assets.

Pillar II: Institutional Custody & Capital (Liquidity Layer) Authority:

SEC Division of Investment Management:

- Precedent: Guidance Update: Qualified Custodians – Sept 30, 2025.

- Implication: The SEC clarified that Registered Investment Advisors (RIAs) may utilize State-Chartered Trust Companies as Qualified Custodians for digital assets.

- Protocol Application: This guidance removes the primary barrier for institutional capital. Family Offices and Credit Funds can now deploy capital into OrthoBridge’s Liquidity Pools while remaining fully compliant with their fiduciary custody mandates.

Pillar III: Federal Banking Integration (Settlement Layer) Authority:

Office of the Comptroller of the Currency (OCC):

- Precedent: Conditional National Trust Charters (Circle, Ripple) – Dec 12, 2025.

- Implication: Digital asset infrastructure providers were granted entry into the Federal Banking System.

- Protocol Application: OrthoBridge relies on Circle and Bridge.xyz for fiat-to-stablecoin conversion. With these partners now holding National Trust Charters, our settlement rails are no longer “Shadow Banking” infrastructure but are federally chartered, drastically reducing counterparty risk for physician users.

>Judicial Precedents and Asset Classification:

The “Rules of the Road“ regarding asset classification were further clarified by two landmark judicial conclusions in 2025:

- SEC v. Coinbase (Feb 27, 2025): Established that secondary market transactions of utility tokens do not automatically constitute securities offerings.

- SEC v. Ripple (Aug 8, 2025): The final settlement provided a clear taxonomy for separating fundraising contracts (Securities) from payment technologies (Commodities/Currencies).

>The Compliance-First Project:

Unlike First-Generation healthcare protocols that viewed regulation as an obstacle, OrthoBridge views regulation as a Moat.

By launching immediately following the OCC and SEC alignment of Q4 2025, OrthoBridge operates within a clear, federally recognized framework. We do not require patients or doctors to circumvent the law; we provide the first streamlined pathway to execute financial settlement through it.

3. Protocol Overview: The Provider-Centric Liquidity Layer

>Mission & Architecture

OrthoBridge is a specialized Real-World Asset (RWA) Protocol architected to solve a single, high-value inefficiency: the Capital Latency inherent in the US orthopedic reimbursement cycle.

Unlike previous generations of healthcare protocols that attempted to disrupt the patient-doctor relationship, OrthoBridge functions purely as backend financial infrastructure. It combines two distinct technological primitives:

- Deterministic Settlement: Using smart contracts to execute trustless, T+1 payment finality.

- Asset-Backed Lending: Utilizing verified surgical claims as collateral for immediate liquidity.

We characterize this as an “Infrastructure-Grade” business model. By design, the protocol rivals the stability of traditional banking sectors rather than the volatility of speculative crypto assets.

>The Provider-Centric Thesis

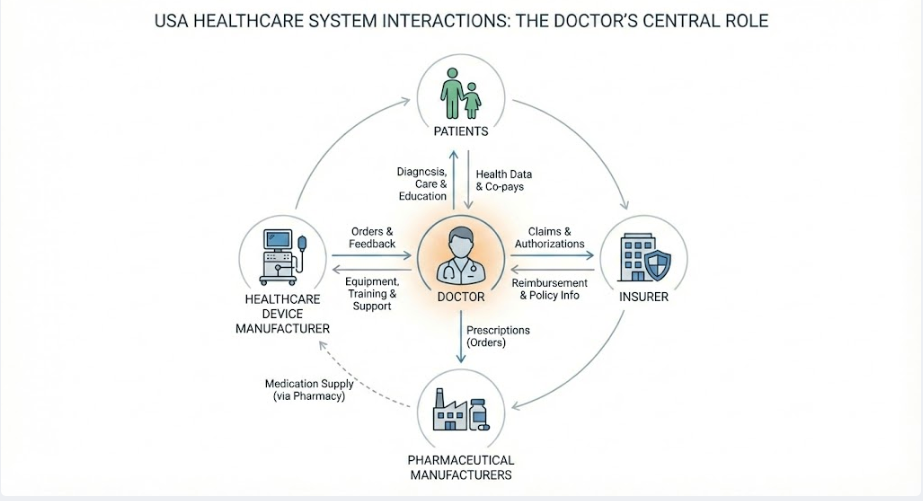

The healthcare ecosystem is composed of four primary stakeholders: Patients, Payers (Insurers), Manufacturers, and Providers (Surgeons/Facilities).

OrthoBridge operates on a Provider-Centric Thesis. Providers function as the central “Relay Nodes” of the healthcare system—they control the clinical decision, the implant selection, and the billing trigger. By solving the liquidity crisis for the Provider, the protocol unlocks efficiency for the entire chain.

Figure 2: Diagram illustrating the Provider as the central liquidity node connecting Patients, Payers, and Manufacturers

>Serviceable Addressable Market (SAM):

OrthoBridge is not a generalized solution for all medical practitioners. It is a precision tool designed for a specific high-value market segment: Independent Orthopedic Surgeons performing high-ticket Arthroplasty procedures.

The protocol specifically targets Ambulatory Surgery Centers (ASCs) and Outpatient Surgery Centers (OSCs). Unlike large hospital systems with massive balance sheets, these independent entities lack the capital reserves to absorb the industry-standard 45-day Accounts Receivable (AR) Latency.(Source: Fox Group, Forbes 2025.)

>Economic : The High-Ticket Asset Class:

The protocol focuses exclusively on Total Hip Arthroplasty (THA) and Total Knee Arthroplasty (TKA) due to their profile as “High-Velocity, High-Value” financial assets.

Asset Unit Economics:

- Total Hip Replacement (THA): Average Transaction Value (ATV) of ~$39,000 USD.

- Total Knee Replacement (TKA): Average Transaction Value (ATV) of ~$32,000 USD.

(Source: CareCredit Market Analysis, 2025)

This high ATV creates a favorable Cost-to-Serve Ratio. Processing a single $39,000 claim generates significantly more yield than processing thousands of low-value primary care visits, ensuring protocol efficiency and deep liquidity depth for investors.

4. Asset Class Selection: The Arthroplasty Investment Thesis

OrthoBridge does not finance “General Healthcare.” It finances a specific, standardized asset class.

The protocol restricts its lending pool exclusively to Total Hip Arthroplasty (THA) and Total Knee Arthroplasty (TKA). This selection is not arbitrary; it is based on four structural characteristics that render these specific procedures suitable for deterministic on-chain settlement.

1.Verification Determinism: The FDA UDI Mandate:

- The Regulatory Lever: FDA 21 CFR 801.20(Unique Device Identification System).

- Mechanism: Federal law mandates that every orthopedic implant (e.g., femoral stem, tibial tray) bears a Unique Device Identifier (UDI) traceable to the patient’s electronic health record.

- Protocol Application: This regulation solves the “Oracle Problem” for physical-world verification. By hashing this mandatory GS1 barcode on-chain, OrthoBridge creates a cryptographic “Proof of Execution” without handling Patient Health Information (PHI). This transforms a medical compliance requirement into a Fraud Prevention Layer, ensuring funds are only released for surgeries that are physically verifiable.

2.Valuation Predictability: The CJR Commodity Model:

- The Regulatory Lever: CMS Comprehensive Care for Joint Replacement (CJR) Model.

- The Mechanism: Unlike variable procedures (e.g., neurosurgery or oncology) where costs fluctuate wildly based on intra-operative complications, THA and TKA operate under a “Bundled Payment” framework.

- Protocol Application: This federal standardization effectively converts the surgery into a Fixed-Price Commodity. Because the reimbursement rate is mathematically bounded and standardized by CMS, the protocol can underwrite the asset value with >98% actuarial accuracy. We are financing a standardized production line, not variable R&D.

3.Risk Mitigation: The “Pre-Auth” Gate:

- The Regulatory Lever: Commercial Payer ‘Prior Authorization‘ Protocols.

- Mechanism: Major US insurers require a strict Prior Authorization review weeks before an elective joint replacement occurs. This acts as a preliminary “Credit Check” on the claim.

- Protocol Application: The protocol utilizes this existing payer infrastructure as a primary risk filter. By validating the Authorization Code on-chain prior to funding, OrthoBridge ensures the claim has already been adjudicated as “Medically Necessary” by the payer, reducing the risk of post-surgery denial to near zero.

4.Structural Liquidity Demand: The “IPO” Shift:

- The Regulatory Lever: Removal of TKA (2018) and THA (2021) from the Medicare Inpatient Only (IPO)

- Mechanism: This policy shift permitted these surgeries to be performed in Ambulatory Surgery Centers (ASCs) for the first time, triggering a massive migration of surgical volume from well-capitalized hospitals to independent, capital-constrained facilities.

- Protocol Application: This shift created an immediate Liquidity Vacuum. Independent ASCs now manage millions in implant inventory without the balance sheet of a hospital system. OrthoBridge addresses this newly created market failure, providing working capital to the specific segment of the market that needs it most.

5.Standardization & Macro-Demand:

- Actuarial Stability: A Total Knee Replacement (CPT 27447) follows a rigid clinical pathway:

- One Implant + Fixed OR Time + One Night Stay. This low clinical variance translates directly to Low Financial Variance for investors.

- Uncorrelated Growth: The asset class benefits from a guaranteed demographic floor. Demand for primary total knee arthroplasties is projected to grow by 673% to 3.48 million procedures by 2030, driven by an aging population regardless of macroeconomic conditions.2 (Source: Kurtz et al., PubMed) / AAOS)

5. Regulatory Compliance Architecture

>Compliance-by-Design Philosophy:

Operating at the intersection of Healthcare (HIPAA/FDA) and Decentralized Finance (SEC/NYDFS) requires a “Compliance-First” architecture. OrthoBridge integrates regulatory logic directly into its smart contract execution layer, ensuring that every transaction adheres to the following eight statutory frameworks.

>Healthcare Data & Safety Standards:

I. Data Privacy: HIPAA Privacy Rule:

- Statute: 45 CFR Part 160 (Health Insurance Portability and Accountability Act).

- Mandate: Federal protection of Protected Health Information (PHI) with strict liability for unauthorized disclosure.

- Protocol Implementation: The protocol utilizes a Zero-Knowledge (ZK) Architecture.

- Off-Chain: Sensitive DICOM images and patient identifiers are stored in compliant, localized vaults (e.g., AWS Nitro Enclaves).

- On-Chain: Only cryptographically salted hashes are committed to the public ledger. This ensures the blockchain serves as a “Verifiable Truth Source” without ever becoming a vector for data leakage.

II. Device Traceability: FDA UDI Rule:

- Statute: 21 CFR 801.20 (Unique Device Identification System).

- Mandate: Requirement for medical devices (e.g., tibial trays, femoral stems) to bear a Unique Device Identifier (UDI) traceable through the supply chain.

- Protocol Implementation: The “Proof of Surgery” mechanism automates the capture of GS1-128 barcodes at the point of care. This creates an immutable, on-chain “Digital Twin” of the implant, providing surgeons with automated compliance logging while offering investors verifiable proof of asset existence.

III. Billing Integrity: The “Two-Midnight” Rule:

- Statute: CMS Regulation (Medicare Part A vs. Part B).

- Mandate: Surgical stays spanning less than two midnights must essentially be billed as Outpatient services. Misclassification results in total claim denial.

- Protocol Implementation: The protocol’s Algorithmic Risk Engine ingests admission metadata prior to funding. It automatically flags high-risk claims (e.g., TKA scheduled as Inpatient) for manual review, preventing the funding of claims that are statistically destined for administrative denial.

Financial & Securities Regulation:

IV. State Licensing: New York BitLicense:

- Statute: 23 NYCRR Part 200 (Virtual Currency Regulation).

- Mandate: Strict licensing requirements for entities engaging in virtual currency business activity involving New York residents.

- Protocol Implementation: OrthoBridge employs a Non-Custodial, Architected Reliance model.

- The protocol never takes custody of user funds.

- Fiat-to-USDC conversion and custody are handled exclusively by Chartered Partners (e.g., Circle, Bridge.xyz) who possess the requisite licenses. This allows the protocol to operate compliantly in New York by layering on top of regulated infrastructure rather than replicating it.

V. Identity Verification: BSA & KYC/AML:

- Statute: Bank Secrecy Act (31 USC § 5311 et seq.).

- Mandate: Financial institutions must verify customer identities to prevent money laundering and sanctions evasion.

- Protocol Implementation: The onboarding “Gatekeeper” integrates directly with the NPPES (National Plan and Provider Enumeration System) database. Every wallet address is cryptographically bound to a verified National Provider Identifier (NPI) and screened against OFAC sanctions lists before interaction is permitted.

VI. Consumer Protection: No Surprises Act:

- Statute: Consolidated Appropriations Act, 2021.

- Mandate: Prohibition of “balance billing” patients for out-of-network services without consent.

- Protocol Implementation: The protocol’s valuation model conservatively factors only the In-Network Rate or the Qualifying Payment Amount (QPA). This ensures that the protocol’s collection rights never exceed what is legally recoverable from the payer, isolating the asset from consumer dispute risk.

VII. Asset Valuation: CJR Model:

- Statute: CMS Comprehensive Care for Joint Replacement.

- Mandate: A bundled payment model that standardizes reimbursement for hip and knee arthroplasty episodes.

- Protocol Implementation: The CJR framework effectively “commoditizes” the surgery, converting a variable medical procedure into a Fixed-Price Financial Asset. This regulatory price floor allows the protocol to underwrite risk with high actuarial confidence, as the reimbursement amount is federally standardized.

VIII. Asset Security: UCC Article 9:

- Statute: Uniform Commercial Code (Secured Transactions).

- Mandate: The legal standard for establishing priority rights in collateralized assets.

- Protocol Implementation: Upon funding, the Smart Contract triggers an automated UCC-1 Financing Statement filing via API. This legally “perfects” the protocol’s lien on the specific Accounts Receivable (AR), ensuring that Liquidity Providers hold senior priority over the asset in the event of a practice’s bankruptcy.

6. Protocol Architecture & Operational Mechanics

>Technical Nomenclature

To ensure precision in protocol specification, the following technical definitions apply:

- RWA (Real World Asset): The on-chain representation of off-chain financial claims. In this protocol, the RWA is a tokenized medical account receivable perfected under UCC-1 statutes.

- DeSci (Decentralized Science): A framework utilizing distributed ledgers to incentivize the generation, validation, and sharing of empirical clinical data.

- Oracle: An authenticated data feed (e.g., Chainlink Functions) that cryptographically verifies off-chain state (e.g., Insurance Authorization status) for on-chain consumption.

- ZKP (Zero-Knowledge Proof): A cryptographic method allowing the protocol to verify the validity of a claim (e.g., “Patient X received Implant Y”) without revealing the underlying sensitive data (PHI), thereby ensuring HIPAA compliance.

- Liquidity Pool (LP): A smart contract-governed capital vault where institutional liquidity providers deposit USDC to underwrite surgical claims in exchange for risk-adjusted yield.

- Atomic Settlement: The irreversible exchange of assets (Claim NFT for USDC) executed instantly upon the satisfaction of programmatic conditions.

- Cryptographic Hash: A deterministic, one-way function used to create a unique digital fingerprint of clinical evidence (X-Rays, Op Notes) for on-chain immutability.

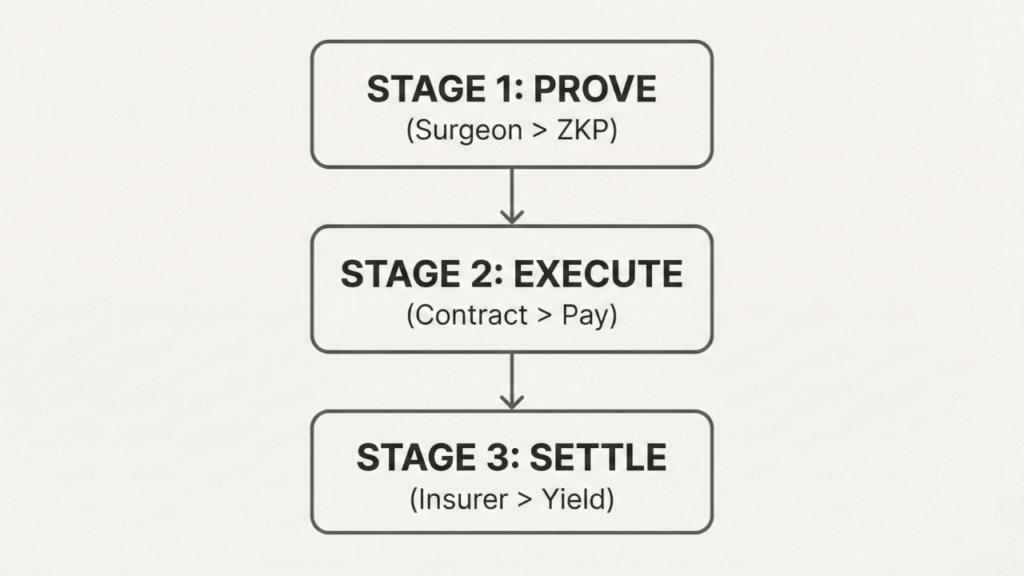

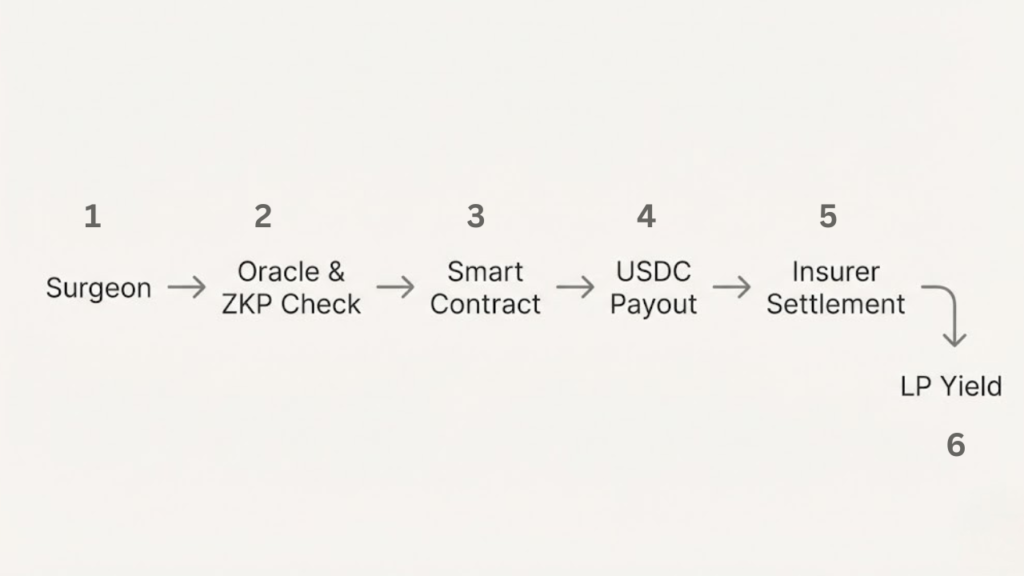

>3 Stages System Overview

The protocol functions in three distinct stages:

- Initiation (Pre-Op): Confirming eligibility via Oracles.

- Execution (Intra-Op): Proving “Work Done” / “Procedure performed” via Cryptographic Hashing.

- Settlement (Post-Op): Releasing liquidity via Smart Contracts.

1. Stage I: The “Pre-Op” Oracle Proof (Initiation)

Before any capital is committed, the protocol must verify the Authorization State.

- The Problem is that Insurance denials often stem from invalid “Prior Authorization” codes.

- The Process:

- Surgeon Client: Queries the Payer’s Database via API for the Status of Authorization Code.

- Chainlink Oracle: Fetches the binary result (Approved / Rejected )and sends this status on-chain.

- Smart Contract: If the status is Approved, the contract mints a “Surgery Ticket (NFT) This NFT represents the right to be paid and holds the lien.

The Oracle queries the insurer’s portal using a “Read-Only” API key, ensuring no patient data is modified, strictly adhering to SOC-2 Type II security standards and Compliance

2. Stage II : The Proof of Surgery (PoS) & Privacy(Execution)

This is the core Step: proving a specific patient received a specific implant without revealing their identity (HIPAA compliance).

A. The “Patient Match” Problem (Solved via Hashing)

How do we know the X-Ray belongs to John Doe without uploading John Doe’s name?

- The “Hash” Solution:

- Local Client: Takes the Patient’s specific attributes (e.g., DOB + Last4SSN + InsurancePolicyID).

- Hashing: Combines these with a secret “Protocol Salt” to generate a unique 256-bit Hash (e.g., 0x7a9…b2).

- Verification: The Oracle independently generates this hash from the Insurance Database. If Local Hash = Oracle Hash, the patient identity is verified on-chain without the name ever leaving the hospital firewall.

B. The “Work Done” Proof (ZKP)

- Input: The Surgeon scans the UDI (Unique Device Identifier) Barcode on the implant box and takes a Post-Op X-Ray.

- Off-Chain Storage: The raw X-ray image is encrypted and stored in a HIPAA-compliant AWS S3 Vault (The “Data Availability Layer”).

- On-Chain Proof: The protocol generates a Zero-Knowledge Proof (zk-SNARK) that attests:

- Statement: “The image stored at this URL contains a knee implant with UDI #12345.”

- Witness: The computer vision algorithm that detected the implant.

- Result: The “Surgery Ticket” NFT is updated with the status EXECUTED.

3. Stage III: Liquidity Settlement / Instant Payout

Once the NFT status is EXECUTED, the settlement setup triggers.

**The doctor receives *USDC* (USD Coin).

Bridge.xyz Integration: An automated API call instantly converts this USDC into Fiat USD and wires it to the doctor’s Chase Bank account via ACH.

User Experience: The doctor sees dollars in their bank in <24 hours. They never touch crypto.

4. STAGE IV: The Reconciliation Loop

- Claim Submission: The app automatically submits the “Clean Claim” (bundled with the ZK Proofs) to the Insurer.

- Reimbursement:

- The Insurer pays the full amount (e.g., $20,000) into a Regulated Lockbox Account.

- Bridge.xyz detects this incoming wire and converts it to USDC.

- The Smart Contract repays the Liquidity Pool (Principal + Fees).

- Yield Distribution:

- The 2% Fee is collected.

- 90% of the fee goes to Liquidity Providers (LPs) as yield.

- 10% goes to the Protocol Treasury.

5. Regulatory Compliance Wrapper

This protocol is not “Permission less.” It is a “Permissioned Real-World Asset (RWA) Ecosystem”:

- KYB (Know Your Business): Only Verified NPI (National Provider Identifier) Surgeons can hold a wallet.

- UCC-1: The Smart Contract automatically triggers a digital filing of a UCC-1 Financing Statement via API. This legally secures the “Surgery Ticket” NFT as a collateralized asset under US Law.

- HIPAA Protection: No PII (Personally Identifiable Information) touches the blockchain. Only Hashes and ZK-Proofs are recorded, rendering the ledger fully HIPAA-compliant.

7. Conclusion: The Inevitability of On-Chain Healthcare Settlement

>The Structural Pivot:

The history of blockchain in healthcare has been defined by a fundamental category error: the attempt to financialize patient data rather than provider liquidity. The market cycles of 2021–2025 demonstrated that while data ownership is a noble philosophical goal, it is not a viable economic engine.

OrthoBridge corrects this misalignment. By pivoting the focus from “Privacy Monetization” to “Capital Efficiency,” the protocol addresses a verified, high-value market failure: the $11 Billion liquidity gap in the orthopedic reimbursement cycle. We posit that the primary utility of distributed ledgers in medicine is not to replace the Electronic Health Record (EHR), but to modernize the financial rails upon which the healthcare system relies.

>The Convergence Thesis

OrthoBridge represents the convergence of three maturing macro-trends in late 2025:

- Regulatory Clarity: The codification of digital asset custody and tokenization by the SEC and OCC has moved RWAs from a “grey market” experiment to an institutional-grade asset class.

- Technological Privacy: The maturation of Zero-Knowledge Proofs (ZKPs) allows for the first time the verification of real-world medical events without compromising the sanctity of HIPAA-protected data.

- Financial Standardization: The federal “commoditization” of arthroplasty procedures (via CJR bundles and UDI mandates) has created the first standardized medical asset capable of deterministic underwriting.

>Future Outlook: From Liquidity to Intelligence

While the immediate mandate of the protocol is Settlement Acceleration, the long-term roadmap extends into Decentralized Science (DeSci). By aggregating cryptographically verified, standardized outcomes data on-chain, OrthoBridge is inadvertently constructing the world’s most rigorous “Real-World Evidence” (RWE) reservoir.

In the near term, we solve the “45-Day Float” for the surgeon. In the long term, we build the “Data Layer” for the next generation of algorithmic medicine.

OrthoBridge is not merely a lending protocol; it is the foundational infrastructure for a healthcare system that settles at the speed of the internet—transparent, compliant, and structurally efficient.